Latest Update

Nov

25

Watch out for the ringgit factor in 3Q corporate earnings

THE corporate earnings reporting season for the quarter ended Sept 30 has started, with more companies releasing their financial results in the next two weeks. The general expectation is that domestic-centric firms will continue to see profit growth, in tandem with the robust economic expansion.More Details Lee Weng Khuen (2024, November 25) Azam Jaya surges 40% on Main Market debutRetrieved from https://theedgemalaysia.com/node/734616

Nov

11

Azam Jaya surges 40% on Main Market debut

KUALA LUMPUR (Nov 11): Sabah-based Azam Jaya Bhd (KL:AZAMJAYA) ended its debut on the Main Market of Bursa Malaysia on Monday with a closing price of RM1.09, a 39.74% or 31 sen rise from its initial public offering price (IPO) of 78 sen.More DetailsLuqman Amin & Yu Jien Lim (2024, November 11) Azam Jaya surges 40% on Main Market debutRetrieved from https://theedgemalaysia.com/node/733397

Nov

07

Construction firm Azam Jaya posts RM4.65 mil profit in 2Q ahead of listing

KUALA LUMPUR (Nov 7): Road infrastructure construction firm Azam Jaya Holdings Bhd (KL:AZAMJAYA), set to list on the Main Market of Bursa Malaysia next Monday (Nov 11), reported a net profit of RM4.65 million or 0.93 sen per share for its second quarter ended June 30, 2024 (2QFY2024).More DetailsLuqman Amin(2024, November 07) Construction firm Azam Jaya posts RM4.65 mil profit in 2Q ahead of listingRetrieved from https://theedgemalaysia.com/node/733131

Oct

28

Azam Jaya's 25 mil IPO shares for public oversubscribed by 23 times

KUALA LUMPUR (Oct 28): Azam Jaya Bhd (KL:AZAMJAYA), a road infrastructure construction firm based in Sabah, announced that its initial public offering (IPO) was oversubscribed by 23 times for the 25 million new shares offered to the Malaysian public.The company is scheduled to be listed on the Main Market of Bursa Malaysia on Nov 11. The IPO involved a total of 128.80 million shares, comprising 78.80 million new shares and an offer for sale of 50 million shares.More DetailsAnis Hazim(2024, October 28) Azam Jaya's 25 mil IPO shares for public oversubscribed by 23 timesRetrieved from https://theedgemalaysia.com/node/731908

Oct

28

TA Securities ascribes RM1.54 fair value to Main Market-bound construction firm Azam Jaya

KUALA LUMPUR (Oct 23): Sabah-based construction outfit Azam Jaya Bhd, which is listing on Bursa Malaysia's Main Market at 78 sen per share, has a fair value of RM1.54 apiece, said TA Securities.The target price is driven by TA Securities' forecast earnings growth of 73.8% in the financial year ending Dec 31, 2025 (FY2025) to RM51.3 million, with price-to-earnings multiple of 15 times — similar to the 15 times price-earnings ratio (PER) ascribed to the initial public offering (IPO) based on its FY2023 net profit, the research house said.More DetailsYu Jien Lim (2024, October 23) TA Securities ascribes RM1.54 fair value to Main Market-bound construction firm Azam JayaRetrieved from https://theedgemalaysia.com/node/731243

Oct

18

Main market-bound Azam Jaya to raise RM61.5m from IPO

KUALA LUMPUR (Oct 18): Main market-bound Azam Jaya Bhd, a Sabah-based construction firm, aims to raise RM61.5 million from its initial public offering (IPO), and set its IPO price at 78 sen per share. From the IPO proceeds of RM61.5 million, the group has allocated RM8.0 million (13.0%) to boost construction capabilities and operational efficiencies by acquiring new machinery and equipment, as well as technological upgrades.More Details Myia S Nair (2024, October 18) Main market-bound Azam Jaya to raise RM61.5m from IPO Retrieved from https://theedgemalaysia.com/node/730683

Oct

01

Azam Jaya signs Inter-Pacific as IPO underwriter, to list on Main Market in November

KUALA LUMPUR (Oct 1): Sabah-based construction firm Azam Jaya Bhd said on Tuesday it has signed an agreement with Inter-Pacific Securities to underwrite its initial public offering (IPO) on the Main Market. Under the agreement, Inter-Pacific will underwrite the IPO shares to be offered to the Malaysian public and eligible persons under the pink form allocation, Azam Jaya said in a statement. The company is scheduled to be listed in November 2024.More DetailsJason Ng (2024, October 1) Azam Jaya signs Inter-Pacific as IPO underwriter, to list on Main Market in November Retrieved from https://theedgemalaysia.com/node/728644

Sep

16

Lower liners taking a back seat in two-tier market

This article first appeared in Capital, The Edge Malaysia Weekly on September 9, 2024 - September 15, 2024WHILE the local bourse continues to see a strong inflow of foreign funds, leading to the FBM KLCI gaining about 15% year to date (YTD), lower liners have yielded relatively lower returns for investors.More DetailsLee Weng Khuen (2024, September 16) Lower liners taking a back seat in two-tier marketRetrieved from https://theedgemalaysia.com/node/726145

Aug

02

Special Report: HRD Corp’s investments in focus

THE Human Resource Development Corporation Bhd (HRD Corp) has come under the spotlight as it made investments involving “put and call option (PCOA) agreements”.Other than publicly traded companies, many of which are linked to tycoon Tan Sri Vincent Tan Chee Yioun and businessman Datuk Eddie Ong Choo Meng, HRD Corp — a government agency under the Ministry of Human Resources — also invested in private companies linked to Tan, namely Berjaya Capital Bhd and Singer (Malaysia) Sdn Bhd.More Details The Edge Malaysia (2024, Aug 2) Special Report: HRD Corp’s investments in focusRetrieved from https://theedgemalaysia.com/node/720920

Jul

26

Alam Maritim submits regularisation plan to exit PN17 status

KUALA LUMPUR (July 26): Practice Note 17 (PN17) company Alam Maritim Resources Bhd (KL:ALAM) has announced its regularisation plan, which includes a share capital reduction of RM440 million, 10-to-one share consolidation, an issuance of renounceable rights shares with warrants and a scheme of arrangement with its creditors.More Details Kang Siew Li (2024, July 26) Alam Maritim submits regularisation plan to exit PN17 statusRetrieved from https://theedgemalaysia.com/node/720610

Jun

14

1Q earnings performance key to sustaining market rally

This article first appeared in Capital, The Edge Malaysia Weekly on May 20, 2024 - May 26, 2024FUELLED by investor optimism, Bursa Malaysia’s benchmark index the FBM KLCI is up more than 10% year to date (YTD), outperforming most of its regional peers.More DetailsLee Weng Khuen (2024, May 27) 1Q earnings performance key to sustaining market rallyRetrieved from https://theedgemalaysia.com/node/712405

Jun

14

Cover Story 2: Improved 1Q results priced in, 2H profit growth seen on track

This article first appeared in The Edge Malaysia Weekly on June 3, 2024 - June 9, 2024THE total net earnings of the FBM KLCI’s 30 component stocks in the first quarter of this year came in at RM17.8 billion, 7.4% higher than the RM16.5 billion recorded in 1Q2023, with 20 companies reporting better earnings, led by Genting Bhd (KL:GENTING) (+500.9%), Sime Darby Plantation Bhd (KL:SIMEPLT) (+205.8%), Press Metal Aluminium Bhd (KL:PMETAL) (+44.7%) and Sime Darby Bhd (KL:SIME) (+41.7%).More DetailsLee Weng Khuen (2024, June 13) Cover Story 2: Improved 1Q results priced in, 2H profit growth seen on trackRetrieved from https://theedgemalaysia.com/node/714195

Apr

03

JAG's stake in KUB up to 62.72% following conclusion of MGO

KUALA LUMPUR (April 3): JAG Capital Holdings Bhd has increased its shareholding in KUB Malaysia Bhd to 62.72% following the conclusion of a mandatory general offer (MGO).In a bourse filing, Maybank Investment Bank, on behalf of JAG, stated that the mandatory general offer (MGO) at 60 per share was concluded on March 18, with JAG Capital acquiring an additional 163.82 million shares, representing 29.44% of KUB.More DetailsChoy Nyen Yiau (2024, Apr 3) JAG's stake in KUB up to 62.72% following conclusion of MGORetrieved from https://theedgemalaysia.com/node/706862

Mar

27

Special Report: Local companies benefiting from ongoing government digitalisation programme

This article first appeared in The Edge Malaysia Weekly on March 18, 2024 - March 24, 2024THE federal government’s ongoing digitalisation initiative has seen some RM1.3 billion worth of contracts being given through various ministries and agencies in the past year to five local companies listed on Bursa Malaysia, data compiled by The Edge shows.More DetailsKamarul Azhar (2024, Mar 27) Special Report: Local companies benefiting from ongoing government digitalisation programmeRetrieved from https://theedgemalaysia.com/node/704957

Mar

11

Better earnings for most FBM KLCI stocks, market rally appears sustainable

This article first appeared in Capital, The Edge Malaysia Weekly on March 4, 2024 - March 10, 2024THE total net earnings of the FBM KLCI’s 30 component stocks for the October to December 2023 period amounted to RM17.7 billion, 27.2% lower than the RM24.4 billion in the last quarter of 2022.More DetailsLee Weng Khuen (2024, Mar 11) Better earnings for most FBM KLCI stocks, market rally appears sustainableRetrieved from https://theedgemalaysia.com/node/703323

Mar

04

JAG's offer for KUB Malaysia turns unconditional

KUALA LUMPUR (Mar 4): The mandatory general offer (MGO) by JAG Capital Holdings Bhd to takeover KUB Malaysia Bhd at 60 sen per share has turned unconditional after the offeror received enough valid acceptances that pushed its stake in KUB past 50% — to 56.75%.JAG is controlled by Minister of Plantation Industries and Commodities Datuk Seri Johari Abdul Ghani, who holds 98.75% in the company.More DetailsEmir Zainul (2024, Mar 4) JAG's offer for KUB Malaysia turns unconditionalRetrieved from https://theedgemalaysia.com/node/703376

Feb

23

KLCI on course for best close since early June 2022

KUALA LUMPUR (Feb 23): Stocks on Bursa Malaysia ticked higher and kept the FBM KLCI on course for its best close since early June 2022.At the midday break on Friday, the benchmark index had gained 0.06% or 0.99 point to 1,546.48. The index earlier rose to a high of 1,551.15.More DetailsSurin Murugiah (2024, Feb 23) KLCI on course for best close since early June 2022Retrieved from https://theedgemalaysia.com/node/702066

Feb

22

KLCI’s technical indicators remain overbought, says Inter-Pacific

KUALA LUMPUR (Feb 22): Inter-Pacific Securities Sdn Bhd said the FBM KLCI’s technical indicators remain overbought, and this could extend the downside pressure on these constituents.In its daily bulletin on Thursday, the research house said the KLCI ended its upward streak on Wednesday as profit-taking activities set in to send the key index lower.More DetailsSurin Murugiah (2024, Feb 22) KLCI’s technical indicators remain overbought, says Inter-PacificRetrieved from https://theedgemalaysia.com/node/701840

Feb

20

KLCI extends gain to fresh 20-month high, energy stocks surge

KUALA LUMPUR (Feb 20): The FBM KLCI charted a fresh 20-month high at midday on Tuesday while Malaysian energy shares surged and plantation stocks also rose.At 12.30pm, the country's benchmark index gained 0.52% or 8.04 points to 1,546.65, its highest since June 3, 2022.More DetailsLuqman Amin (2024, Feb 23) KLCI extends gain to fresh 20-month high, energy stocks surgeRetrieved from https://theedgemalaysia.com/node/701549

Feb

19

Bursa gets off to lacklustre start on weaker-than-expected economic growth

KUALA LUMPUR (Feb 19): Stocks on Bursa Malaysia got off to a lacklustre start on Monday morning, against the backdrop of slower-than-expected economic growth of 3% year-on-year in the fourth quarter of 2023.At 9.05am on Monday, the FBM KLCI had added 0.04% or 0.58 point to 1,534.13.More DetailsSurin Murugiah (2024, Feb 19) Bursa gets off to lacklustre start on weaker-than-expected economic growthRetrieved from https://theedgemalaysia.com/node/701326

Feb

12

Encouraging FBM KLCI rally but doubts persist

This article first appeared in Capital, The Edge Malaysia Weekly on February 5, 2024 - February 11, 2024FOLLOWING the woes brought about by the sell-off in the shares of 16 small-capitalisation counters on Bursa Malaysia in mid-January, the tide seems to have turned, favouring counters with larger market capitalisation. This can be seen in the performance of the benchmark index, the FBM KLCI, which gained more than 4% or 58 points in the first month of this year, making it the best performer in the region.More DetailsIntan Farhana Zainul (2024, Feb 12) Encouraging FBM KLCI rally but doubts persistRetrieved from https://theedgemalaysia.com/node/699805

Feb

09

Kumpulan Jetson, KUB, Reneuco, CIMB, BHIC, Dataprep, MGB, RCE Capital, KKB, NationGate, Southern Acids, Perdana Petroleum, Globetronics, Industronics

KUALA LUMPUR (Feb 8): Here is a brief recap of some corporate announcements that made the news on Thursday: Kumpulan Jetson Bhd, KUB Malaysia Bhd, Reneuco Bhd, CIMB Group Holdings Bhd, Boustead Heavy Industries Corp Bhd, Dataprep Holdings Bhd, MGB Bhd, RCE Capital Bhd, KKB Engineering Bhd, NationGate Holdings Bhd, Southern Acids (M) Bhd, Perdana Petroleum Bhd, Globetronics Technology Bhd and Industronics Bhd.More DetailsSurin Murugiah (2024, Feb 19) Kumpulan Jetson, KUB, Reneuco, CIMB, BHIC, Dataprep, MGB, RCE Capital, KKB, NationGate, Southern Acids, Perdana Petroleum, Globetronics, IndustronicsRetrieved from https://theedgemalaysia.com/node/700460

Dec

11

Lack of momentum in year-end window dressing, say analysts

DECEMBER is typically a month of gains for equities buoyed by window-dressing activities by portfolio managers. In the past five years, the FBM KLCI rose between 0.4% and 4.1% during the month, while the FBM Emas Index and FBM Top 100 Index also saw increases from 2019 to 2022, but not in 2018.More DetailsLee Weng Khuen (2023, Dec 11) Lack of momentum in year-end window dressing, say analystsRetrieved from https://theedgemalaysia.com/node/692731

Dec

05

Rising cocoa bean prices suppress Guan Chong’s performance

SINCE peaking at RM3.70 in August 2020, shares in cocoa grinder Guan Chong Bhd have been heading south, in tandem with the surge in cocoa bean prices to the highest levels seen in more than 40 years, driven mainly by the tight supply of cocoa beans and the El Niño weather.More DetailsLee Weng Khuen (2023, Dec 5) Rising cocoa bean prices suppress Guan Chong’s performanceRetrieved from https://theedgemalaysia.com/node/691693

Oct

16

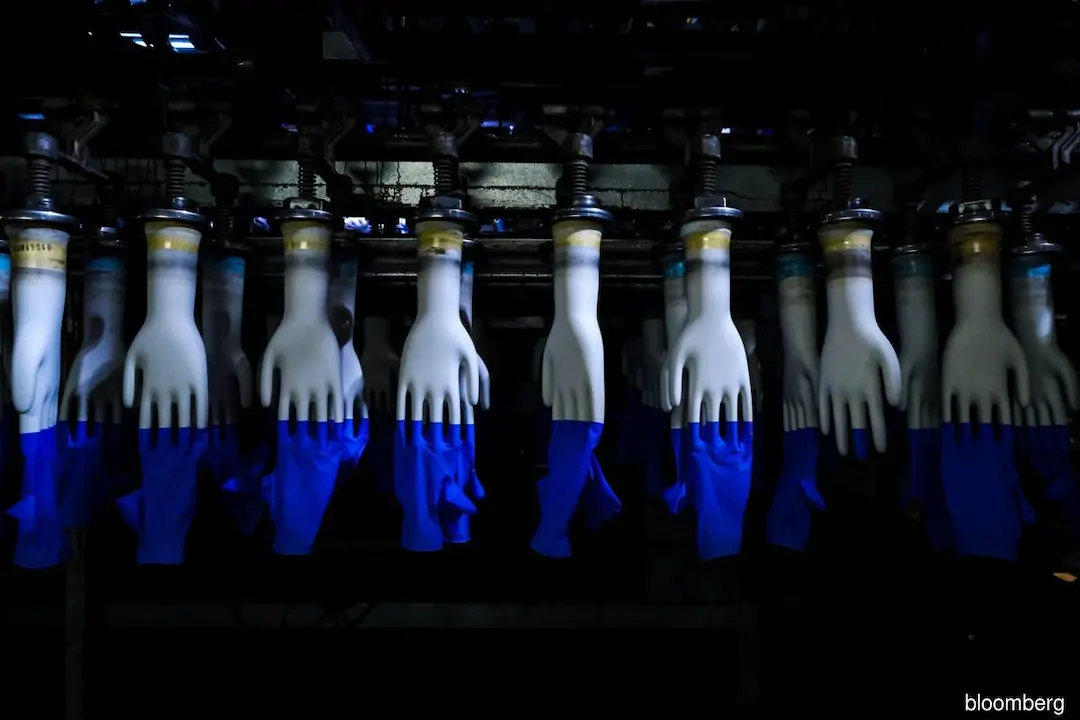

Glove stocks projected to see meaningful recovery only towards end-2024

BATTERED by falling demand, oversupply and stiff competition from China and Thailand, the local glove industry is slowly recovering, but a more substantial improvement can only be expected in the second half of 2024 at the soonest, according to analysts.More DetailsLee Weng Khuen (2023, Oct 16) Glove stocks projected to see meaningful recovery only towards end-2024Retrieved from https://theedgemalaysia.com/node/685359

Oct

05

Cover Story: Construction, solar companies seen as key beneficiaries of Budget 2024

CONSTRUCTION and solar companies are expected to be the main beneficiaries of Budget 2024, according to analysts who are looking forward to more details on the execution of the recently unveiled New Industrial Master Plan 2030 (NIMP) and National Energy Transition Roadmap (NETR).More DetailsLee Weng Khuen (2023, Oct 05) Cover Story: Construction, solar companies seen as key beneficiaries of Budget 2024Retrieved from https://theedgemalaysia.com/node/683948

Sep

12

2Q earnings worse y-o-y but better on quarterly basis

BURSA Malaysia-listed companies largely reported a worse set of numbers for the quarter ended June 30 (2Q2023) from a year ago. But on a quarterly basis, more companies registered better results — offering a sliver of hope for the local capital market.More Details Kamarul Azhar (2023, September 12) 2Q earnings worse y-o-y but better on quarterly basisRetrieved from https://theedgemalaysia.com/node/681287

Aug

28

Blue-chip stocks in focus as foreign funds return

THE recent return of foreign funds to the local bourse has fuelled a strong momentum in blue-chip stocks, especially in banking and plantation. Since early July, the Bursa Malaysia Financial Services Index and Plantation Index have gained 7.1% and 5% respectively, contributing to the 6.3% rise in the benchmark FBM KLCI. At the same time, the Technology Index has also delivered a stellar performance, rising 5.9%, though none of the tech stocks is an FBM KLCI constituent.More Details.Low Yen Yeing (2023, August 28) Blue-chip stocks in focus as foreign funds return.Retrieved from https://theedgemalaysia.com/node/679601

Jul

13

Cover Story 2: Can things get any worse in 2023?

Just like in 2022, financial markets continued to be impacted by the shockwaves from rising interest rates, geopolitical risks and recession fears in the first half of the year (1H2023).Despite the chaos around the world, US equities have been on the rise — the Dow Jones Industrial Average is up 3% year to date (YTD) while the S&P 500 has advanced 15%. This is a stark contrast to the FBM KLCI, which has declined 7%.More DetailsLiew Jia Teng and Kathy Fong (2023, July 13) Cover Story 2: Can things get any worse in 2023?Retrieved from https://theedgemalaysia.com/node/673503

Jul

10

Top active SkyWorld Development closes 7.5% below IPO price on Main Market debut

KUALA LUMPUR (July 10): Property developer SkyWorld Development Bhd ended its maiden trading day on Monday (July 10) at 74 sen, down 7.5% or six sen from its initial public offering (IPO) price of 80 sen. The counter’s intraday low was at 73 sen, while its intraday high was at 81 sen. More DetailsHailey Chung (2023, July 10) Top active SkyWorld Development closes 7.5% below IPO price on Main Market debut.Retrieved from https://theedgemalaysia.com/node/674140

Jul

01

Double cover: Hefty bill for low water tariffs and 2H market outlook

KUALA LUMPUR (July 1): Almost two decades since the passing of the Water Services Industry Act 2006 (WSIA), the spirit of the act, which seeks to provide a framework for a sustainable water services industry, is still a work-in-progress.The water services industry’s financing model is still far from sustainable, leading to low investments in assets, as tariffs, especially on domestic users, have not been increased even as operating costs go up.More DetailsKamarul Azhar(2023, July 1) Double cover: Hefty bill for low water tariffs and 2H market outlook.Retrieved from https://theedgemalaysia.com/node/673191

Jun

30

Main Market-bound SkyWorld shares offered to public oversubscribed by 0.19 times

KUALA LUMPUR (June 30): Property developer SkyWorld Development Bhd, which is set to be listed on the Main Market of Bursa Malaysia on July 10, saw the 50 million new shares offered to the public oversubscribed by 0.19 times.The issuing house, Tricor Investor & Issuing House Services Sdn Bhd, said a total of 3,378 applications for 59.5 million shares worth RM47.6 million were received from the public for the 50 million shares offered at 80 sen per share.More DetailsPriyatharisiny Vasu (2023, Jun 30) Main Market-bound SkyWorld shares offered to public oversubscribed by 0.19 timesRetrieved from https://theedgemalaysia.com/node/673159

Jun

20

Maybulk proposes RM139 mil vessel disposal to fund future diversification move

KUALA LUMPUR (June 20): Malaysian Bulk Carriers Bhd (Maybulk) has proposed to dispose of its bulk carrier Alam Kekal to realise the vessel's increased market value amid elevated commodity demand.In a bourse filing on Tuesday (June 20), the dry bulk carrier operator said it proposes to obtain a shareholders’ mandate for the vessel’s disposal to a non-related third party for a cash consideration of not lower than 90% of the market value as ascribed by an independent valuer.More DetailsIzzul Ikram (2023, Jun 20) Maybulk proposes RM139 mil vessel disposal to fund future diversification moveRetrieved from https://theedgemalaysia.com/node/671911

May

10

Downward earnings revisions dominate before 1Q results season enters full swing

KUALA LUMPUR (May 10): More Bursa Malaysia-listed companies have seen analysts revising downwards their earnings forecasts recently, data compiled by The Edge showed, hinting at more negative than positive earnings surprises so far this year.Of the 36 companies with analyst coverage that have released their latest quarterly results since April, 20 or 55.6% of these companies saw their consensus full-year earnings forecasts revised downwards, while just five companies or 13.9% saw their earnings forecasts adjusted higher.More DetailsAdam Aziz & Sufi Muhamad(2023, May 10) Downward earnings revisions dominate before 1Q results season enters full swing.Retrieved from https://theedgemalaysia.com/node/666276

May

09

Loss-making Hartalega rebounds to nine-month high amid better than expected financial results

KUALA LUMPUR (May 9): Hartalega Holdings Bhd’s share price staged a strong rebound although it reported a large quarterly net loss of RM302.75 million and a big drop in revenue for the fourth quarter ended March 31, 2023.The buying interest was mainly because the latest set of earnings figures came in better than expected on quarterly comparison. The tone of Hartalega’s management also appeared more upbeat compared with the previous quarter, according to analysts. More DetailsHailey Chung (2023, May 9) Loss-making Hartalega rebounds to nine-month high amid better than expected financial results.Retrieved from https://theedgemalaysia.com/node/666271

May

08

Selling emerges on glove stocks after Hartalega’s move to slash capacity

KUALA LUMPUR (May 8): Hartalega Holdings Bhd’s plan to decommission its Bestari Jaya production facility to weather through tough market landscape confirms that the downturn is likely to prolong in the glove industry.That news has triggered some selling pressures on glove stocks on Bursa Malaysia.More DetailsChester Tay (2023, May 8) Selling emerges on glove stocks after Hartalega’s move to slash capacity.Retrieved from https://theedgemalaysia.com/node/666061

Mar

02

Cover Story: A lift in market sentiment

.png)

RETAIL investors stayed on the sidelines for most of last year, the cautious sentiment continuing from 2021 when investors’ irrational exuberance started to taper off after the initial supercharged liquidity of Covid-19 loan moratoriums.While eking out a profit was certainly more challenging for retail investors last year, things have turned more positive in the past few months — at least among the lower liners, judging by the indices.More DetailsLee Weng Khuen(2023, March 2) Cover Story: A lift in market sentiment.Retrieved from https://www.theedgemarkets.com/node/656073

Jan

26

Vincent Tan continues trimming BCorp stake

KUALA LUMPUR (Jan 26): Berjaya Corp Bhd (BCorp) founder and major shareholder Tan Sri Vincent Tan Chee Yioun has now trimmed his stake in the diversified group to 19.061%.Tan sold two blocks of shares in a direct business transaction on Wednesday (Jan 25). According to BCorp’s filings, he sold 110.08 million shares via Hotel Enterprise Sdn Bhd and another 15.92 million shares through B & B Enterprise Sdn Bhd.More Details Syafiqah Salim(2023, January 26). Newsbreak: Berjaya Corp eyes controlling stake in MCIS Life.Retrieved from https://www.theedgemarkets.com/node/650991

Jan

20

BCorp founder Vincent Tan pares stake to 21.3%, inches closer to 19.6% end-Jan target

KUALA LUMPUR (Jan 20): Berjaya Corp Bhd (BCorp) founder and major shareholder Tan Sri Vincent Tan Chee Yioun has pared his stake in the group to 21.317%, inching closer to his target of 19.600% by end-January.Over the past two weeks, Tan has offloaded 132 million shares, which slashed his direct shareholding to 436.27 million shares or a direct equity interest of 7.814%. More Details Izzul Ikram(2023, January 20). BCorp founder Vincent Tan pares stake to 21.3%, inches closer to 19.6% end-Jan target.Retrieved from https://www.theedgemarkets.com/node/652588

Jan

16

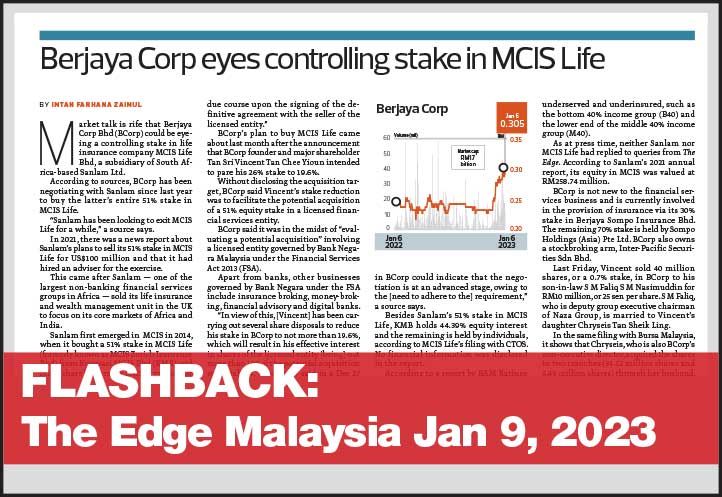

Newsbreak: Berjaya Corp eyes controlling stake in MCIS Life

MARKET talk is rife that Berjaya Corp Bhd (BCorp) could be eyeing a controlling stake in life insurance company MCIS Life Bhd, a subsidiary of South Africa-based Sanlam Ltd.According to sources, BCorp has been negotiating with Sanlam since last year to buy the latter’s entire 51% stake in MCIS Life.More Details Intan Farhana Zainul(2023, January 16). Newsbreak: Berjaya Corp eyes controlling stake in MCIS Life.Retrieved from https://www.theedgemarkets.com/node/650991

Jan

10

BCorp says acquisition target is MCIS Insurance, confirms The Edge report

KUALA LUMPUR (Jan 10): Berjaya Corp Bhd says it is in the midst of negotiations for the proposed acquisition of a controlling stake in MCIS Insurance Bhd (MCIS Life)It announced this in a brief bourse filing on Tuesday (Jan 10) night, confirming a report by The Edge Malaysia over the weekend that the group was in talks with Sanlam Ltd to purchase the South Africa-based company’s 51% stake in MCIS Life.More Details. Izzul Ikram(2023, January 10). BCorp says acquisition target is MCIS Insurance, confirms The Edge reportRetrieved from https://www.theedgemarkets.com/node/651237

Dec

28

Vincent Tan pares stake in BCorp for 'potential major acquisition in financial services segment'

KUALA LUMPUR (Dec 27): Berjaya Corp Bhd's (BCorp) founder and major shareholder Tan Sri Vincent Tan Chee Yioun intends to pare his stake to 19.6% from 26%, paving the way for the diversified group's potential acquisition of a 51% stake in a financial services company.In a statement, BCorp, in which Tan is chairman, said it is in the midst of evaluating a potential acquisition involving a licensed entity governed by Bank Negara Malaysia (BNM) under the Financial Services Act 2013 (FSA).More Details.Chester Tay(2022, December 28). Vincent Tan pares stake in BCorp for 'potential major acquisition in financial services segment'.Retrieved from https://www.theedgemarkets.com/node/649693

Oct

17

No systemic risk from troubled Credit Suisse

THE turmoil at Credit Suisse Group arising from the spike in its default swaps has shaken the financial markets with the worry that it might be the Lehman Brothers of 2022.Is this cause for concern for the global banking system, as October generally is a volatile month for global equities?Lee Weng Khuen (2022, October 17). No systemic risk from troubled Credit Suisse from https://www.theedgemarkets.com/article/no-systemic-risk-troubled-credit-suisse

Aug

19

Market conditions are likely to remain mostly indifferent, says Inter-Pacific

KUALA LUMPUR (Aug 19): Inter-Pacific Securities Sdn Bhd said market conditions are likely to remain mostly indifferent as the FBM KLCI appears to be toppish following its 7% rebound in July.In its daily bulletin on Friday (Aug 19), the research house said Malaysian stocks were mostly rangebound amid the continuing profit taking on some of the heavyweights that made significant headway of late.More DetailSurin Murugiah. (2022, August 19). Market conditions are likely to remain mostly indifferent, says Inter-Pacific. The Edge.Retrieved from https://www.theedgemarkets.com/article/market-conditions-are-likely-remain-mostly-indifferent-says-interpacific.

Jul

19

Near-term Outlook for Local Market Has Improved

THE EDGE: Inter-Pacific Research Sdn Bhd said Malaysian stocks regained traction on Monday as it rose to its highest level in nearly two weeks with the FBM KLCI also climbing back near to the 1,430 level.In its daily bulletin on Tuesday (July 19), the research house said the recovery was in tandem with the ongoing calmness in global equities with bargain hunting emerging on energy stocks as oil prices regained the US$100/bbl mark. More detailsSurin Murugiah. (2022, July 19). Near-term outlook for local market has improved. The Edge.Retrieved from https://www.theedgemarkets.com/article/nearterm-outlook-local-market-has-improved-says-interpacific

Jun

01

Late buying pushes KLCI turnover, volume to multi-year highs

KUALA LUMPUR (June 1): Late buying interest pushed the FBM KLCI up 1.75% in the last 10 minutes of the trading day on Tuesday (May 31), ahead of changes that will take place in the MSCI’s equity indices as part of its bi-annual review.The 11th-hour rally turned the Malaysian benchmark index into one of Tuesday’s best performers in the Southeast Asia region, as it spiked 1.75% or 27.08 points to 1,570.10, its highest in almost four weeks. More Details Adam Aziz and Justin Lim (2022, June 01). Late buying pushes KLCI turnover, volume to multi-year highs. Retrieved from https://www.theedgemarkets.com/article/late-buying-pushes-klci-turnover-volume-multiyear-highs

May

24

Trailing demand a temporary blip for aluminium players

COMMODITIES may still be riding an upward trend, but metal prices have melted to pre-Russia-Ukraine conflict levels. Aluminium, for one, has seen year-to-date gains erased on demand headwinds, especially the slowdown in China’s manufacturing activity due to Covid-19 lockdowns. Since surging past US$3,800 a tonne in March this year — the highest in more than 13 years — aluminium prices have retreated 30% to a five-month low of US$2,700 a tonne.More Details Lee Weng Khuen. (2022, May 24). Market conditions are likely to remain mostly indifferent, says Inter-Pacific. The Edge.Retrieved from https://www.theedgemarkets.com/article/trailing-demand-temporary-blip-aluminium-players

Mar

29

Buying interest appeared to have diminished on lack of new leads, says Inter-Pacific

THE EDGE: Inter-Pacific Securities Sdn Bhd said the buying interest appeared to have diminished on the back of the lack of new leads and the directionless trading environment looks to persist over the near term. In its daily bulletin on Tuesday (March 29), the research house said with fewer catalysts, the market is likely to stay fluid and most market players are likely to remain on the sidelines for the time being. More detailsSurin Murugiah. (2022, March 29). Key index stocks may retrace over the near term. The Edge.Retrieved from https://www.theedgemarkets.com/article/buying-interest-appeared-have-diminished-lack-new-leads-says-interpacific

Mar

25

Key index stocks may retrace over the near term

THE EDGE: Inter-Pacific Securities Sdn Bhd said despite Thursday’s (March 24) gains, conditions on Bursa Malaysia are still fluid and the near-term outlook will be largely dictated by overseas events for the time being.In its daily bulletin on Friday, the research house said this could also mean that key index stocks may retrace over the near term, in line with the weakness in key global indices overnight with the re-emergence of inflationary concerns as crude oil and other commodity prices remain elevated due to the ongoing geopolitical conflict in eastern Europe that shows little signs of abating.More detailsSurin Murugiah. (2022, March 25). Key index stocks may retrace over the near term. The Edge. Retrieved from https://www.theedgemarkets.com/article/key-index-stocks-may-retrace-over-near-term

Mar

24

Conditions on Bursa Malaysia are still fluid, sentiment remains cautious

THE EDGE: Inter-Pacific Securities Sdn Bhd said despite Wednesday’s (March 23) gains, conditions on Bursa Malaysia are still fluid and the near-term outlook will be largely dictated by overseas events for the time being. In its daily bulletin on Thursday, the research house said this could also mean that key index stocks may retrace over the near term, in line with the weakness in key global indices overnight with the re-emergence of inflationary concerns as crude oil and other commodity prices remain elevated due to the ongoing geopolitical conflict in eastern Europe that shows little signs of abating. More details Surin Murugiah. (2022, March 24). Conditions on Bursa Malaysia are still fluid, sentiment remains cautious. The Edge. Retrieved from https://www.theedgemarkets.com/article/conditions-bursa-malaysia-are-still-fluid-sentiment-remains-cautious

Mar

22

Cautious market sentiment prevails, KLCI to stay range-bound

THE EDGE: Inter-Pacific Securities Sdn Bhd said The market appears to have hit a plateau, unable to move past the 1,580 points convincingly of late in the absence of more compelling impetuses to provide the much-needed lift. More details Surin Murugiah. (2022, March 22). Cautious market sentiment prevails, KLCI to stay range-bound. The Edge. Retrieved from https://www.theedgemarkets.com/article/cautious-market-sentiment-prevails-klci-stay-rangebound

Mar

18

KLCI likely to end week on firmer footing

THE EDGE: Hong Leong Investment Bank (HLIB) Research said that tracking further relief rally from Wall Street, the FBM KLCI could inch higher to retest 1,600-1,620 levels but cautious sentiment prevails, as investors continue to weigh on the slow progress in Russia-Ukraine ceasefire talks, FOMC’s latest hawkish tilt policy coupled with worries over the Covid-19 situation in China.More detailsSurin Murugiah. (2022, March 18). KLCI likely to end week on firmer footing. The Edge.Retrieved from https://www.theedgemarkets.com/article/klci-likely-end-week-firmer-footing

Mar

15

Market players likely to remain cautious, says Inter-Pacific

THE EDGE: Inter-Pacific Securities Sdn Bhd said with the immediate market outlook remaining unsettled, most market players are likely to remain cautious in their approach.In its daily bulletin on Tuesday (March 15), the research house said the ongoing war in eastern Europe and the corresponding high input cost is also keeping market players wary over its near-term direction.More detailsSurin Murugiah. (2022, March 15). Market players likely to remain cautious, says Inter-Pacific. The Edge.Retrieved from https://www.theedgemarkets.com/article/market-players-are-likely-remain-cautious-says-interpacific

Mar

11

There could be more near-term upsides on bargain-hunting activities, says Inter-Pacific

THE EDGE: Inter-Pacific Securities Sdn Bhd said with market conditions showing mild signs of improvement, there could be more near-term upsides as bargain-hunting activities look to continue, supported by sustained buying from foreign funds.More detailsSurin Murugiah. (2022, March 11). There could be more near-term upsides on bargain-hunting activities, says Inter-Pacific. The Edge.Retrieved from https://www.theedgemarkets.com/article/there-could-be-more-nearterm-upsides-bargain-hunting-activities-says-interpacific

Feb

24

Cover Story: Softer corporate earnings seen in first half

THE EDGE: FACED with the ongoing Omicron wave, which saw new Covid-19 cases per day breach the 20,000 mark in Malaysia last Friday, local corporates may find themselves having to battle a potential decline in earnings because market sentiment has soured.More detailsLee Weng Khuen. (2022, February 24). Cover Story: Softer corporate earnings seen in first half. The Edge.Retrieved from https://www.theedgemarkets.com/article/cover-story-softer-corporate-earnings-seen-first-half

Jan

17

Technology the focus in 2022 as market remains flush with liquidity

THE EDGE: AFTER a lacklustre performance by most sectors in 2021, investors are hoping for a rebound this year. But is that likely and, if so, in which sectors?Early indications are not so promising. Last Wednesday, investors in the US were spooked by the latest Federal Reserve meeting minutes that signalled interest rate hikes may take place sooner than expected. The tech-heavy Nasdaq plunged more than 3% while the Dow Jones and S&P 500 lost 1.07% and 1.94% respectively.More detailsLee Weng Khuen. (2022, January 17). Technology the focus in 2022 as market remains flush with liquidity. The Edge.Retrieved from https://www.theedgemarkets.com/article/technology-focus-2022-market-remains-flush-liquidity#.YiWvh5cN9kM/

Jan

14

Bursa technology stocks tumble again as US tech shares crash on US tapering concern

THE EDGE: Technology stocks on Bursa Malaysia tumble again as US big tech shares crashed on US tapering concerns.It was again a sea of red for the sector with Bursa Malaysia Technology Index slipping 5.52 points or 6.2% to 83.45 on Friday’s (Jan 14) noon break.More detailsTan Siew Mung. (2022, January 14). Bursa technology stocks tumble again as US tech shares crash on US tapering concern. The Edge.Retrieved from https://www.theedgemarkets.com/article/bursa-technology-stocks-tumble-again-us-tech-shares-crash-us-tapering-concern

Dec

06

Rate hikes in developed markets and strong US dollar may prompt fund outflow

THE EDGE: FOREIGN funds have been net buyers of Malaysian equities for seven straight weeks, although their net buying narrowed sharply to RM66.61 million for the week ended Nov 19 from RM359.14 million in the previous week.More detailsLee Weng Khuen. (2021, December 06). Rate hikes in developed markets and strong US dollar may prompt fund outflow. The Edge.Retrieved from https://www.theedgemarkets.com/article/rate-hikes-developed-markets-and-strong-us-dollar-may-prompt-fund-outflow/

Feb

21

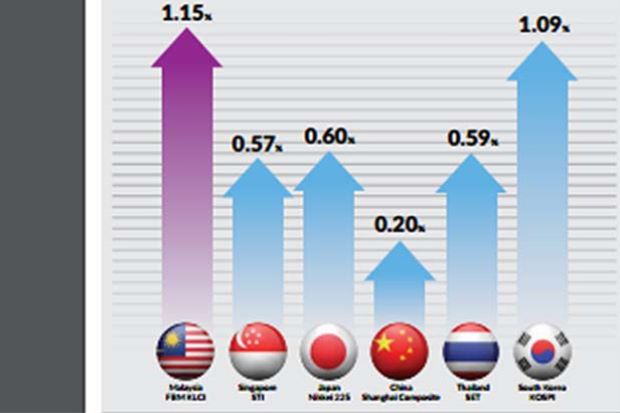

Malaysian Stocks Stage Strongest Rise in Asia

PETALING JAYA: The FBM KLCI put up strong gains in yesterday’s trading session, rising 19.62 points or 1.15% to 1,726.18 points by the end of the day, recording its third day of gains. All Asian markets with the exception of Australia’s ASX rose, with gains in Malaysia being the strongest compared to other Asian markets. The local benchmark index also rose in line with increased risk sentiment in nearly all Asian markets after US president Donald Trump indicated that he might be willing to push back the trade talk deadline with China from March. The FBM KLCI has been rising for the past three days since the trading week began on Monday, racking up gains of 32.26 points from Monday’s open to Wednesday’s close. Gains were broad-based in yesterday’s trade, as all segments of the market were in the green. All indices of Bursa Malaysia posted gains yesterday, with the Bursa Malaysia Construction index rising the most by 3.91% closely followed by the Bursa Malaysia Energy Index going up 3.27% and the FBM Palm Oil Plantation Index gaining 2.35%. InterPacific Securities research head Pong Teng Siew told StarBiz that while gains have been seen since Monday, the big upward move materialised from Tuesday to Wednesday’s trade. “I believe the catalyst came from Wednesday’s news that the country was making progress in talks with China to revive the earlier scrapped East Coast Rail Link (ECRL) project. The biggest gainers on Bursa Malaysia for both Tuesday and Wednesday came from the construction index,” Pong said. “And also, there are other factors coming into play right now, including rising oil prices as we see Brent crude oil rising to its three-month high,” he added. As at press time, Brent crude oil was near its three-month high of US$65.89 per barrel. The commodity, which is still essential to the health of the Malaysian economy, has been rising since Christmas last year. Dealers contacted by StarBiz said it would appear that foreign money is buying into Malaysia once again. “We saw the data and this is what it showed. These are the big boys that are buying in again. The reason could be due to the Malaysian growth story, but this has yet to be confirmed on my end,” a dealer said. Locally, Finance Minister Lim Guan Eng had said in his speech in a government function in Kuala Lumpur City Centre on Monday that it was now the “best time” to invest in Malaysia, especially in the small and medium enterprises segment of the economy. “I strongly encourage you to buy into the Malaysian growth story as soon as possible before we fully recover in three years, in which it would be too late by then. If you had yet to invest in Malaysia and had waited for three years, I would hate to tell you I told you so,” Lim said. Malaysia last week announced that its fourth-quarter economic growth had surpassed expectations with gross domestic product (GDP) growing at 4.7% compared with the same quarter of the previous year. This marks the local economy’s first acceleration in growth over the last one year, following the continued slowdown in GDP growth after the third quarter of 2017 where it registered a 6.2% growth. Lee Heng Guie, an economist and the executive director of the Socio-Economic Research Centre, said the better FBM KLCI performance in January and the recent days of February had been fueled by several factors, including the better reading of the fourth-quarter GDP growth, which indicates that the Malaysian economy was coming out of the trough. “There is also renewed investor interest in Malaysian equities, as the stocks look attractively valued aided by the prospect of the ringgit’s appreciation; investors generally are positive about Khazanah Nasional Bhd’s divestment plan as it improves market liquidity,” Lee said. “Other than the ECRL, which would benefit many of these contractors, there are also other factors coming in. “I am looking at penny stocks and the oil and gas (O&G) stocks that have also risen along with the technology sector. Namely, there are stocks that are below the RM1 level in the O&G sector that are jumping on the rising crude oil theme,” Pong said. Among the active stocks yesterday were from the O&G space, including Sapura Energy Bhd which rose 4.84% to 32.5 sen, Hibiscus Petroleum Bhd that added 2.86% to RM1.08, and Bumi Armada Bhd that gained 4.65% to 22.5 sen. Top gainers were from the consumer sector, including Nestle (M) Bhd which rose RM1.50 to RM150.00, Fraser & Neave Holdings Bhd adding 90 sen to RM35.90, and Carlsberg Brewery Malaysia Bhd gaining 60 sen to RM23.74. Pong said these consumer stocks have been posting strong dividends on the back of commendable financial performance, and hence, investors were buying into their stocks. On whether the gains could continue and be sustained, Pong said that it would ultimately have to boil down to earnings, which he said have not been too bad. “The fourth quarter is turning out to be more mixed than many had thought. The third quarter was a disaster in terms of earnings and for things like the ECRL. Many of these stocks (in the construction sector) have been beaten down and are at very cheap levels now. If the project is reinstated, then these companies stand to benefit,” Pong said. Daniel, Khoo. (2019, February 21). Malaysia stocks stage strongest rise in Asia. The Star. Retrieved from https://www.thestar.com.my/business/business-news/2019/02/21/hattrick-for-bursa/

Feb

20

KLCI hits our 2H2018 base case target of 1630: What next?

The downswing in the KLCI exhibits all the hallmarks of a bear market at this point. 1) Liquidity has been progressively drained out of the market by a drawn-out foreign fund selloff that has drawn in local funds as well as retail participants. 2) Stock valuations remain at elevated levels despite eye-watering drawdowns from peak levels due to a dismal earnings report card for several reporting seasons already. 3) Poor personal income growth following an inflationary bout beginning 2015 that extended into 2017 did no favours for already waning animal spirits among domestic investors. Across the rural heartlands and the myriad little towns that serve them, falling agricultural commodity prices weighed heavily on incomes. In the near future, too many uncertainties about investment outcomes, and yet hopes are high Tech stocks may boom anew, contingent on a resolution of trade issues but a confidence reboot is still premature. Commodity prices may recover fleetingly in 1H2019 but too late to boost Plantation/O&G stocks. A global slowdown threatens to overshoot, paving the path for a hard landing. The Construction sector is at 2008 levels, a victim of wrecking balls swung by the Parkatan Harapan government at mega projects. Properties, still mired in Bank Negara Malaysia’s macroprudential muck and despite strong demographic trends and low rates, affordability stifles demand. A swift consumer recovery is unlikely as goods prices are sticky downwards. So, sky high sector valuations will not outlast any stock market bounce that unfolds. Loans growth pickup courtesy of a weak Ringgit straining working capital may falter again as the Ringgit stabilizes, maybe dampening optimism for a still inexpensive Finance sector. Our 1H2018 KLCI target of 1907 was achieved for all intents and purposes with the KLCI cresting at 1896. We were off by 11 index points. We still expect that at its worst valuation level the KLCI will retrace to will least match the –1 Standard Deviation below the mean valuation between[…]. Open an account with us to view full report.

Jan

23

Dow Jones Industrial Average

The Dow Jones Industrial Average fell 87.80 points to 21,812.09. The Nasdaq Composite lost 19.07 points to 6,278.41.Benchmark U.S. crude oil rose 58 cents to settle at $48.41 per barrel.

Independent adviser deems KUB Malaysia takeover offer 'not fair and not reasonable', tells shareholders to reject offer

KUALA LUMPUR (Feb 8): Independent adviser Inter-Pacific Securities Sdn Bhd has deemed the unconditional mandatory takeover offer for KUB Malaysia Bhd by JAG Capital Holdings Bhd major shareholder Datuk Seri Johari Abdul Ghani as "not fair and not reasonable", advising shareholders to reject the offer.More DetailsChoy Nyen Yiau (2024, Feb 8) Independent adviser deems KUB Malaysia takeover offer 'not fair and not reasonable', tells shareholders to reject offerRetrieved from https://theedgemalaysia.com/node/700358